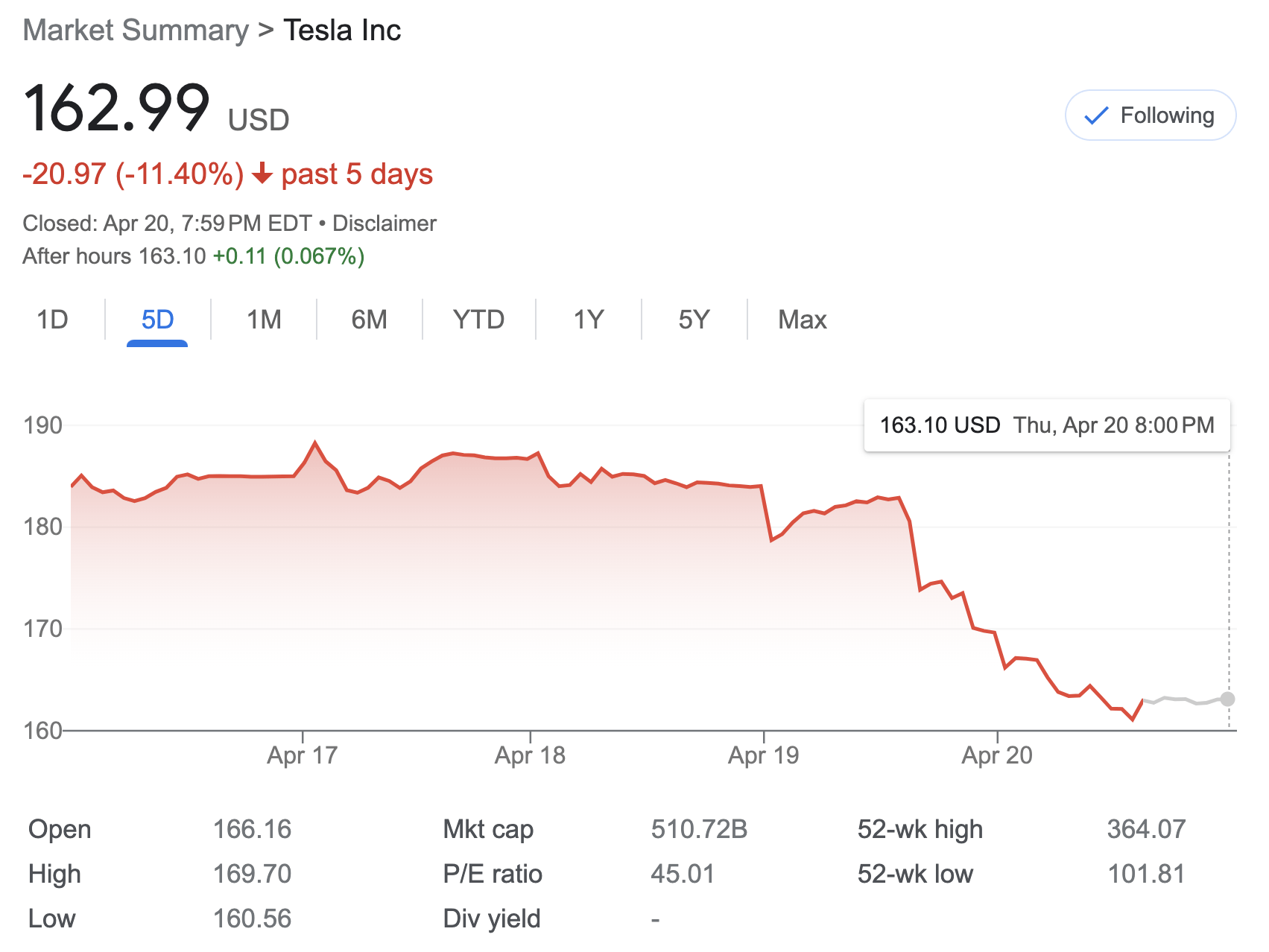

Tesla TSLA -9.30% (ticker: TSLA) stock had another terrible day after earnings. Investors know all too well that can happen. Tomorrow should be better.

Shares tanked for the third consecutive time after the electric-vehicle maker reported quarterly numbers. Shares dropped 9.7% after the company reported first-quarter 2023 earnings. Shares dropped, amazingly, the same percentage after it reported second-quarter numbers. Shares dropped 9.3%, closing at $220.11, after the auto maker posted disappointing third-quarter results on Wednesday.

The S&P 500

SPX

and Nasdaq Composite

COMP

fell 0.9% and 1%, respectively.

The problem was essentially profit margins and pricing. Price cuts pushed operating profit margins below 8%, down almost 10 percentage points year over year. Tesla CEO Elon Musk didn’t sound upbeat on the company’s conference call either, talking about high interest rates hurting demand and stormy economic seas.

History tells us Telsa may get a mild bounce now. Shares have gained an average of 0.4% the day after a post-earnings drop and have risen seven times. A week after the big drop, shares have gained an average of 1.4%, essentially picking up another percentage point from the Day One rebound.

CappThesis founder and market technician Frank Cappelleri tells Barron’s there are a few key levels for investors to watch. Tesla stock started the year at about $123 a share and traded above $290. At $222 it has given up Capelleri’s 38%, which is a level watched by technical traders. When a stock drops by that much, traders look to buy.

Two other levels are the $217 level, equal to the February and June highs. And the $214 level, which is the 200-day moving average. Falling below $214 would signal more pain for investors.

He isn’t making a fundamental call on the stock. He is looking at the stock charts to get a sense of levels where investors have stepped in to buy in the recent past.

Tesla investors are used to volatility around earnings reports. The average move, up or down, for Tesla stock after an earnings report is about 7%. The average move for Apple

AAPL

(AAPL) shares is about 4%.

Tesla stock drops about 58% of the time after earnings. Apple Shares rise about 58% of the time after earnings.

And Tesla has missed earnings estimates 13 times in the past 41 quarters. Apple has missed earnings three times.

Tesla is a unique stock.