The U.S. national debt skyrocketed on the very first day of the new fiscal year, jumping $204 billion to a new record of $35.669 trillion, reflecting ongoing fiscal challenges. What’s worse is that the Treasury also had to draw down its cash balance by $72 billion—that’s over $275 billion in the red. The new record amount of U.S. government debt on the first day of the government fiscal year amounted to $204 billion in a single day.

The data sent shockwaves across the country with many saying that America is headed for bankruptcy. Tesla CEO Elon Musk was prominent among those, who posted on X saying, “America is headed for bankruptcy.”

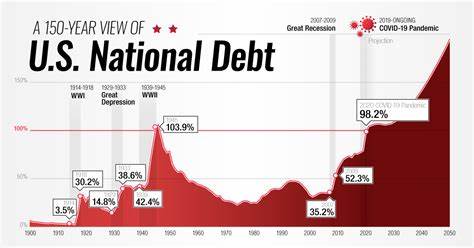

Debt-to-GDP Ratio

The ratio of federal debt to GDP is a critical metric for assessing fiscal health. It is projected to rise from approximately 99% in 2024 to about 116% by 2034, reflecting concerns about long-term sustainability as interest costs and mandatory spending continue to grow faster than revenues.

Key Factors Contributing to the Debt Surge

- Interest Costs: Interest payments on the national debt have been a major driver of this increase. In the first ten months of the previous fiscal year, interest costs totaled approximately $956 billion, marking a 32% rise compared to the same period in 2023. With interest rates rising due to the Federal Reserve’s aggressive monetary policy aimed at combating inflation, these costs are expected to exceed $1 trillion for the fiscal year.

- Budget Deficit: The budget deficit for the fiscal year has also been substantial. By July 2024, the deficit had reached $1.52 trillion, down slightly from the previous year but still significantly larger than pre-pandemic levels. Higher revenues from tax receipts have helped narrow this gap somewhat, but spending continues to outpace income.

- Rising Debt Levels: The U.S. national debt has been on an upward trajectory, having crossed the $30 trillion mark in February 2022 and now standing at approximately $34.4 trillion. This growth reflects a combination of increased government spending and lower-than-expected tax revenues.

- Economic Factors: The economic landscape continues to be impacted by various factors, including inflation and global uncertainties. These conditions affect government revenues and expenditures, complicating efforts to effectively manage the national debt.

Implications for Fiscal Policy

The escalating federal debt poses significant challenges for U.S. fiscal policy:

- Interest Rate Impact: As interest rates remain elevated, servicing the debt will consume an increasing portion of federal spending, potentially crowding out other critical areas such as infrastructure and social programs.

- Policy Adjustments: Lawmakers may need to consider adjustments to tax policies or spending priorities in response to these fiscal pressures. Discussions around increasing revenue through tax reforms or reducing expenditures are likely to intensify.

- Long-Term Sustainability: The rising debt raises questions about long-term economic sustainability and financial stability. Economists warn that continued borrowing at such high levels could lead to adverse effects on economic growth and investor confidence.

As interest costs rise and budget deficits persist, policymakers will face difficult choices in balancing economic growth with fiscal responsibility in the coming years.

dodb buzz I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!