Form-16 streamlines income tax filing for employees, offering a comprehensive overview of their earnings and deductions. It enables taxpayers to precisely declare income and avail deductions during income tax return (ITR) filing.

Income Tax Return: This month, employers are scheduled to issue the Form 16 every year on or before June 15. Following this, salaried individuals can expedite the income tax return filing process. Form 16 is one of the several

Form 16 is a crucial document that plays an instrumental role in filing income-tax returns (ITR), especially for salaried individuals. It is the responsibility of employers to provide their employees with Form 16 at the conclusion of every fiscal year. This significant document details the quantity of tax deducted from an employee’s pay, which has also been consequently submitted to the government on behalf of the said employee.

“Form 16 acts as a crucial piece of documentation for filing your income tax return (ITR). The information in this form pre-populates sections of your ITR, saving you time and effort. It also serves as proof that your employer deducted and deposited the tax on your behalf,” said Avinash Godkhindi, CEO & MD, Zaggle Prepaid Ocean Services.

Form 16 and ITR filing

Form-16 streamlines income tax filing for employees, offering a comprehensive overview of their earnings and deductions. It enables taxpayers to precisely declare income and avail deductions during income tax return (ITR) filing.

It contains:

> Salary Income Details: Form 16 provides a comprehensive breakdown of your salary income for the previous financial year. This includes your basic salary, allowances, deductions claimed, and any other taxable components.

> Tax Deducted at Source (TDS): This section highlights the total amount of tax deducted from your salary by your employer throughout the financial year. It also details how this TDS was deposited with the Income Tax Department on your behalf.

> Two parts

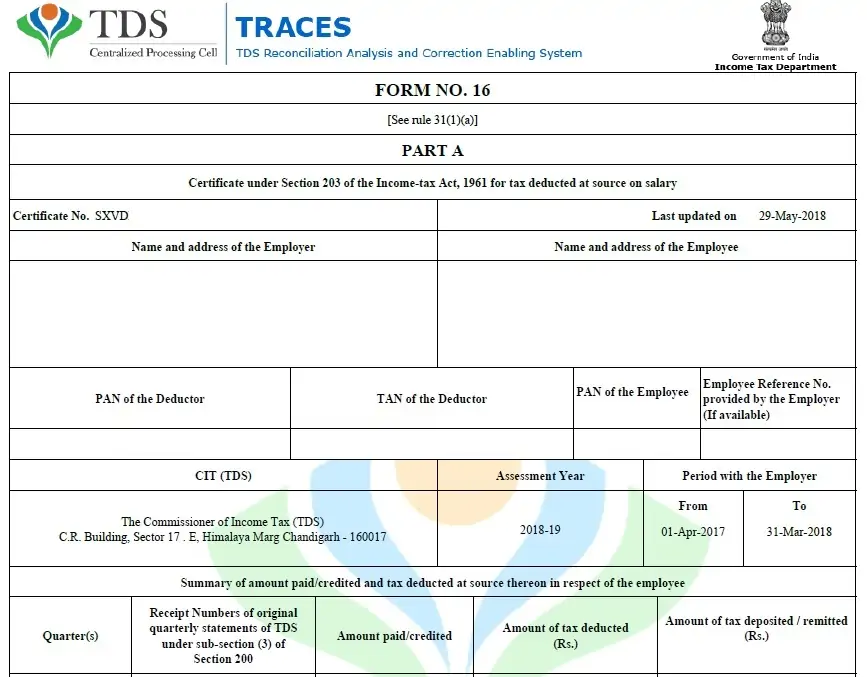

There are two parts of the Form 16. Form 16-A summarises an employee’s tax deductions made by the employer and sent to the I-T department. It represents the employee’s tax situation but should not be mistaken for Form 16. Both Form 16 and Form 16-A serve different purposes.

Form 16-B consolidates financial details like salary, deductions, and additional income for an employee. It includes data from both the employee and the employer, offering a comprehensive overview of the individual’s financial situation.

> Part A: Focuses solely on TDS information, including the deducted tax amount and challan details (payment slips) used for depositing the TDS with the government.

> Part B: Provides a detailed breakup of your salary income, including allowances, deductions claimed, and other tax-related details.

5 steps to consider as soon as you get your Form 16 for FY24

Explaining more about the Form 16, Godkhindi said it acts as a tax certificate detailing your salary income for the previous financial year and the Tax Deducted at Source (TDS) by your employer. In simpler terms, it shows how much you earned and how much tax the government already collected from your salary.

After you get the Form 16, Godkhindi said one should:

> Review and Verify the information: Carefully examine Form 16 to ensure all details are accurate. This includes your personal information, employer details, income breakup, deductions claimed, Tax Deducted at Source (TDS) information, etc.

> Compare with Form 26AS: Download your Form 26AS from the Income Tax Department’s website. This form provides a consolidated view of your tax deducted at source (TDS) by all deductors (including your employer). Compare the TDS information in both forms to identify any discrepancies.

> Address Discrepancies (if any): If there are any mismatches between Form 16 and Form 26AS, reach out to your employer’s HR or finance department to rectify the errors. They can file a revised TDS return to correct the information. Once done, you’ll receive an updated Form 16.

> Prepare for Income Tax Filing: With a verified Form 16, you can start preparing to file your income tax return (ITR). Gather all necessary documents like bank statements, investment proofs for tax deductions, etc.

> File Your Income Tax Return (ITR): Use the details mentioned in Form 16 to fill out the appropriate ITR form on the Income Tax Department’s e-filing portal. The form will pre-populate income details based on Form 16 information.